Cultivation | CO₂ Sequestration | Carbon Credit | Opportunity | Feasibility

Agarwood (Aquilaria spp.) plantations offer a dual-impact opportunity:

- Environmental restoration & CO₂ sequestration

- High-value product generation via resin (oud)

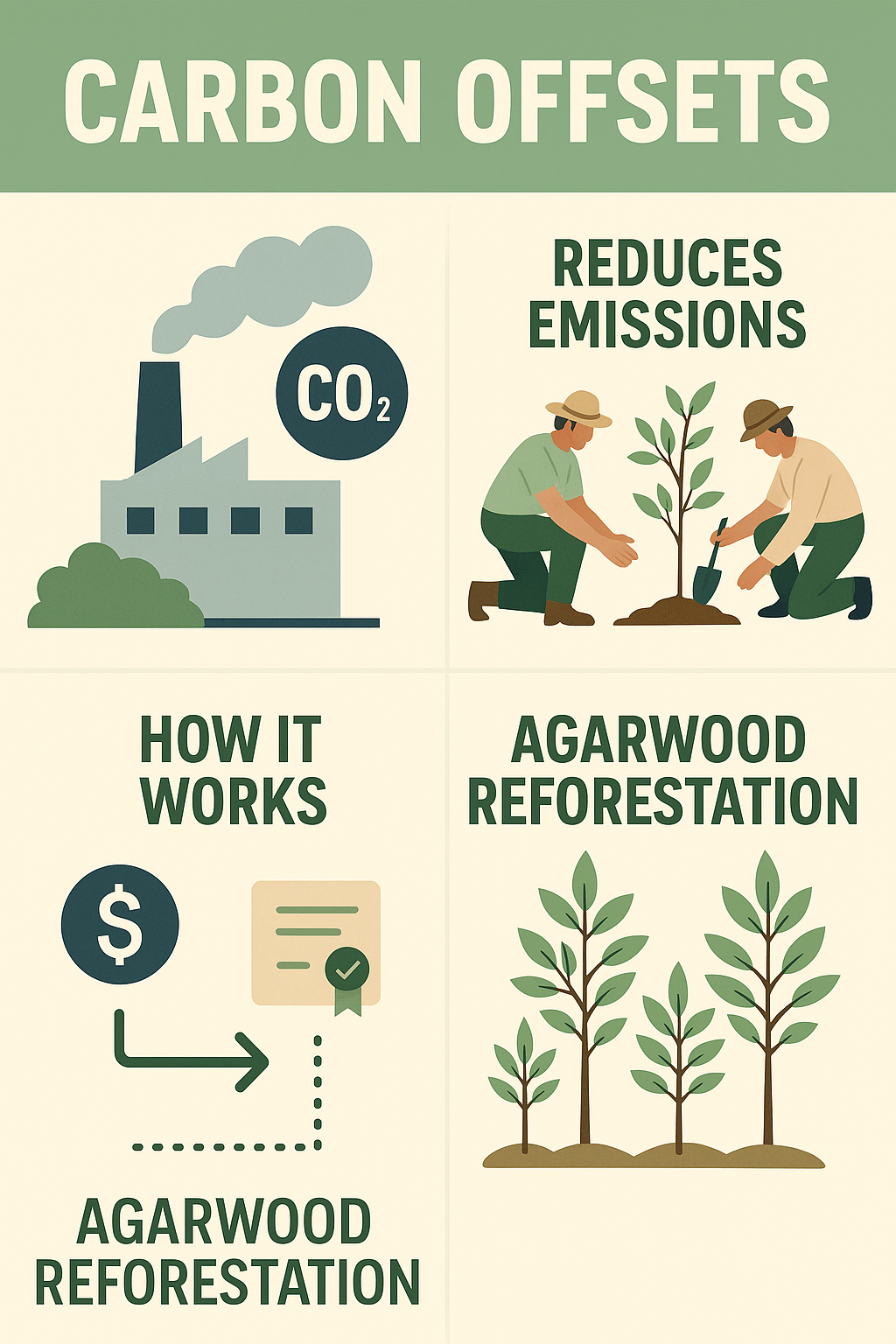

What Are Carbon Credits?

A carbon credit = 1 ton of CO₂ removed or avoided Companies buy these credits to offset their emissions under:

- Voluntary Carbon Markets (e.g. Verra, Gold Standard)

- Compliance Markets (e.g. for national or sectoral caps)

Why Agarwood?

- Aquilaria spp. are fast-growing tropical trees

- Planted in degraded or idle lands = additional carbon sink

- Carbon is stored in trunks, roots, branches, and soil

- No deforestation—trees remain standing even after resin harvest

- Compatible with agroforestry, increasing total sequestration

How Agarwood Earns Carbon Credits

| Step | Description |

|---|---|

| 1. Baseline Study | Establish existing carbon levels (usually low in degraded lands) |

| 2. Plantation Establishment | Trees are planted at ~1,100 trees/ha |

| 3. Growth & Monitoring | Biomass accumulation measured annually |

| 4. Verification | Auditors assess CO₂ sequestered |

| 5. Carbon Credit Issuance | Verified credits sold to offsetters |

Potential Income (Example)

- 100 hectares of Aquilaria

- Average sequestration: 30 tCO₂e/ha/year

- Over 10 years: 30,000 credits

- At $10/credit = $300,000

Carbon credits can be claimed in parallel with oud resin harvest returns.

Who Buys Carbon Credits?

- Global corporations (Google, Shell, Unilever)

- Airlines, energy firms, and logistics companies

- ESG-driven investors and climate funds

- Carbon brokers and marketplaces (e.g. South Pole, Puro.earth)

Offsetting Benefits for Investors or Developers

- Diversified revenue model (carbon + oud resin)

- Improved project finance eligibility

- Marketing advantage (climate-positive label)

- Eligibility for CSR, ESG or green bond funding

- Can link to NFTs for tree traceability and investor engagement